What Is Zero-Knowledge KYC? A Complete Guide to Privacy-First Identity Verification

The Real Problem With Identity Verification in the Digital Age

In today’s increasingly digital world, identity verification has become unavoidable. Whether users are opening a bank account, accessing online services, trading digital assets, or interacting with decentralized finance platforms, they are repeatedly asked to prove who they are.

The problem is not verification itself.

The problem is how identity verification is handled.

To participate in the modern financial system, users are routinely required to share sensitive personal data — passport scans, biometric data, personal documents, and other personally identifiable information — with financial institutions and centralized platforms. Each submission creates new copies of the same information, stored across multiple databases.

This approach has led to repeated data breaches, widespread identity theft, and growing distrust across the financial sector. Centralized data storage creates large datasets that become attractive targets for attackers, and once identity data is exposed, the damage is permanent.

That’s why the real tension isn’t privacy versus compliance.

It’s outdated identity models versus modern digital risk.

What Is Zero-Knowledge KYC?

Zero-Knowledge KYC (ZK-KYC) is a privacy-preserving approach to identity verification that allows platforms to verify identities without revealing sensitive personal data or underlying data.

Instead of submitting full identity documents to every service, users prove specific attributes of their identity using zero knowledge proof technology. These proofs confirm that requirements are met — such as age, jurisdiction, or compliance status — without exposing the actual data behind the claim.

This allows organizations to:

- Handle identity verification responsibly

- Maintain regulatory compliance

- Reduce unnecessary data storage

- Preserve user privacy across online transactions

Zero-Knowledge KYC does not remove KYC.

It modernizes it.

How Zero Knowledge Proofs Work (The Bartender Analogy)

Zero knowledge proofs (ZKPs) can sound complex, but the core idea is surprisingly simple.

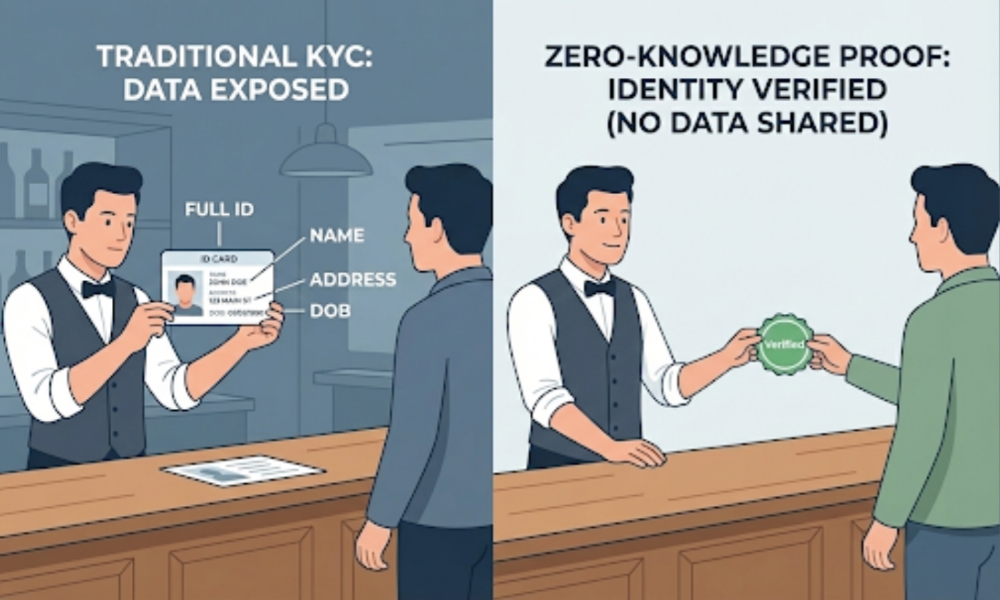

Imagine a bartender checking whether someone is legally allowed to buy alcohol.

In traditional KYC, the customer hands over their ID. The bartender sees everything: full name, address, exact birthdate, and ID number. To verify one fact, all personal details are exposed.

With Zero-Knowledge KYC, the interaction works differently.

Instead of sharing an ID, a digital identity system simply confirms:

“This person is over 18.”

The bartender verifies the requirement without ever seeing the underlying data — no birthdate, no address, no document scan. The fact is proven, while the data remains private.

Technically, this is achieved through cryptographic proofs known as zero-knowledge proofs, which allow one party to prove a statement is true without revealing the information behind it.

(For a technical overview, see the definition of zero-knowledge proofs on Wikipedia:

https://en.wikipedia.org/wiki/Zero-knowledge_proof)

This is what makes zero knowledge proofs such a powerful tool for digital identity verification.

Why Traditional KYC Creates Risk: Data Breaches and Centralized Control

Traditional KYC processes rely on a central authority to collect, store, and manage identity data. Financial institutions and KYC providers maintain large centralized databases filled with sensitive personal data, biometric data, and personal documents.

These centralized identity verification systems introduce several risks:

- Large datasets increase exposure to data breaches

- Central entities become single points of failure

- Long-term data storage creates regulatory liability

- Identity theft becomes harder to prevent or reverse

Data breaches involving identity data are especially damaging because identity information cannot be reset. Once personal details are exposed, users may face lifelong consequences.

As privacy regulations such as the General Data Protection Regulation (GDPR) increasingly emphasize data minimization and user protection, this centralized model becomes harder to justify

(see: https://gdpr.eu/what-is-gdpr/).

Zero-Knowledge KYC as a Paradigm Shift in Regulatory Compliance

Zero-Knowledge KYC represents a paradigm shift in how the financial system approaches regulatory compliance.

Traditional KYC processes require organizations to collect more data than necessary, increasing operational costs and data protection responsibilities. Privacy regulations demand stricter controls over how personal data is handled, stored, and retained.

Zero-Knowledge KYC resolves this conflict.

By verifying identities without revealing sensitive personal data, organizations can:

- Meet KYC and AML requirements

- Reduce unnecessary data storage

- Improve regulatory adherence

- Lower compliance-related operational costs

Instead of storing identity data, platforms rely on cryptographic proofs to verify identities. Compliance becomes verifiable without being invasive.

Decentralized Identity, Blockchain Technology, and DeFi

Decentralized identity plays a central role in Zero-Knowledge KYC systems. Using decentralized identifiers and self-sovereign identity models, users retain control over their digital identities rather than relying on central entities.

Blockchain technology enables on-chain verification of zero knowledge proofs through smart contracts. This allows platforms to validate identity claims transparently, without storing personal data or depending on centralized intermediaries.

For decentralized finance (DeFi), this is critical.

DeFi platforms operate without traditional financial institutions, yet still face pressure to fight fraud and money laundering. Zero-Knowledge KYC allows decentralized exchanges and DeFi applications to verify identities while preserving their decentralized nature and reducing transaction costs.

How Verifyo Delivers Privacy-Preserving KYC at Scale

Verifyo delivers a production-ready Zero-Knowledge KYC solution designed for today’s digital ecosystem.

Instead of collecting personal documents, Verifyo enables:

- Reusable identity verification

- Zero knowledge proofs tied to verified attributes

- Strict access controls without centralized data storage

Platforms verify identities through Verifyo’s infrastructure and the Merchant Token (MTO) ecosystem using a Hold-to-Use model. This allows businesses to access advanced compliance tooling — including machine learning models — without per-verification fees.

Organizations looking to implement privacy-first identity verification can learn more about Verifyo’s approach on the official Verifyo Zero-Knowledge KYC platform:

https://verifyo.com

Conclusion: The Future of Identity Verification

Zero-Knowledge KYC is not an experimental concept. It is the natural evolution of identity verification in an increasingly digital world.

By reducing data breaches, strengthening regulatory compliance, and preserving user privacy, it addresses the structural weaknesses of traditional KYC processes.

For the financial sector, digital asset platforms, and decentralized finance ecosystems, adopting Zero-Knowledge KYC is no longer optional.

With Verifyo, privacy-preserving identity verification becomes a competitive advantage — not a regulatory burden.

Share this content: